RETAIL

L.A. County Sees Uptick in Vacancy

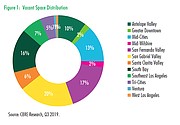

Vacancy for commercial properties hit 5.7 percent in Los Angeles County during the 2019 3rd quarter, according to a report released on Oct. 28 by commercial-real-estate services and investment firm CBRE.

It was a slight increase from the previous quarter, when vacancy was 5.4 percent, and the first quarter, when vacancy was measured at 5.1 percent. Closures of big-box stores such as National Stores Fallas and Sears contributed to vacancy in the county, previous reports said. While L.A. County is the address for world-renowned shopping districts such as Rodeo Drive, it also hosts malls such as the former Westside Pavilion that have been repurposed into creative office space.

Recent retail bankruptcies might bring more vacancies in the near future. Los Angeles–headquartered Forever 21 declared bankruptcy in September. According to a Nov. 6 Wall Street Journal article, the fast-fashion retailer will close 88 U.S. stores. Forever 21 runs 20 locations in Southern California, though it is currently unknown if any of the stores in this region will close.

The CBRE report said that the majority of the Forever 21 stores are located in neighborhoods with low vacancy rates. Possible closures will give opportunities to new retailers who have not been able to move into areas that have experienced tight real-estate markets. Other spaces occupied by high-profile retailers will soon hang out “For Lease” signs. When it was announced that Barneys New York would be acquired by the Authentic Brands Group, the luxury retailer also revealed that it would close its bricks-and-mortar stores, including its Los Angeles location in Beverly Hills, Calif.

More commercial space became available this year when LF Stores announced that it would shutter its fleet of 26 bricks-and-mortar stores. The store closures included locations in retail neighborhoods such as Robertson Boulevard and Larchmont Avenue in Los Angeles, as well as in Manhattan Beach, Calif.

The report was not all bad news, however, as there are opportunities in the Los Angeles County retail-real-estate scene, according to CBRE. Most leasing activity was marked by grocery stores and fitness centers. During the 3rd quarter, space totaling 20,000 square feet in Los Angeles County was leased by Whole Foods, Gold’s Gym and Planet Fitness. The report also looked forward to a number of new projects opening in Los Angeles’ northern districts, including the San Fernando Valley.

One of the notable projects forecasted to be completed in 2020 is NoHo West, a 570,000-square-foot mixed-use development in North Hollywood, Calif., located on Laurel Canyon Boulevard between Erwin and Oxnard streets. According to the property’s website and media reports, the 190,000-square-foot campus will feature a gym, a supermarket and a multiplex cinema. NoHo West is a joint venture between GPI Companies and Merlone Geier Partners, which has worked on properties such as the former Laguna Hills Mall, currently being redeveloped in Laguna Hills, Calif.

Other major developments, according to the report, are the Promenade 2035 in Woodland Hills, Calif. Currently under environmental review, the proposed development could feature 244,000 square feet of retail shops, restaurants, hotel space, 1,432 residential units and a 15,000-square-foot sports-and-entertainment center. If this project’s plans are approved, construction is forecasted to start in 2021, according to media reports.

Demolition also started at the Sportsmen’s Lodge in Studio City, Calif., during Labor Day weekend. For this project, look forward to more fitness centers and high-end supermarkets. Scheduled to move into the more than 80,000-square-foot site are 22 shops, an Equinox fitness center and an Erewhon supermarket. The project is scheduled to be open to the public in fall 2020.

CBRE also released a report for commercial real estate in Orange County. Vacancy rates inched up to 3.5 percent in Q3 2019 from 3.4 percent in the previous quarter. Demand for space was led by boutique fitness companies, medical health clinics and small-format grocery stores such as Bristol Farms.