UCLA Anderson Forecast Sees a Downshifting in the Economy

For the past year, the U.S. economy has been traveling at 80 miles per hour as tax cuts and federal stimuli revved up financial growth in 2018.

But by next year the economy may be riding the brakes at only about 30 mph as tax cuts disappear, the global economy shrinks and the trade deficit grows.

That was the conclusion of the first quarterly report for 2019 by the UCLA Anderson Forecast, which sees the country’s gross domestic product growing at only 1.7 percent this year and to a near-recession pace of 1.1 percent in 2020.

Economists will have a better idea if the economy is headed into a recession by the second half of 2020. “It is going to be a close call,” said David Shulman, senior economist with the UCLA Anderson Forecast. Whenever the economy falls below 1 percent, you can be in that zone where any outside event can push you into a recession.”

If there is any silver lining in this darkening cloud, it is that interest rates will probably start declining next year when the Federal Reserve is expected to make three benchmark interest-rate cuts of 25 basis points each as the economy cools. This year, the Federal Reserve is predicted to enact two rate hikes after making four in 2018, bringing the benchmark interest rate to 2.25–2.5 percent.

“If I were a business I would go for it this year,” Shulman said. “I think the risk is more in 2020 than 2019.”

A slowing economy is based on several factors. One is that major economies around the world are stuck in low gear. China, the world’s second-largest economy, saw its slowest GDP growth in 28 years last year. Its economy in 2018 grew at 6.6 percentage points, which seems robust by Western standards but was down 0.2 percent from the previous year.

Europe saw only 1.8 percent economic growth in 2018 compared with a 3 percent GDP rise in the United States.

Shulman noted that the country’s weakness is being amplified by the Trump administration’s protectionist trade policy, which has implemented tariffs covering $250 billion on various Chinese products, and that could increase. He also pointed to the uncertainty surrounding Great Britain’s March 29 exit, known as Brexit, from the European Union.

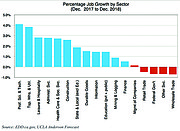

But U.S. payrolls will continue to expand, even if it is at a much more moderate rate than in the last couple of years. “Payroll employment growth will decline from its monthly record of 220,000 to about 160,000 per month in 2019 and a negligible 20,000 per month in 2020, with actual declines occurring at the end of that year,” Shulman noted.

The current U.S. unemployment rate of 3.8 percent will decline to 3.6 percent later this year and then gradually rise to 4.2 percent in early 2021.

When it comes to investment in the economy, one bright spot is in intellectual property, which consists mostly of software development, motion picture/television production, and corporate research and development. That sector is expected to expand at a faster rate than the rest of the economy because of corporate computing moving to the cloud and a number of new entrants, including Amazon, Netflix and Hulu, to motion-picture production.

California also hits some speed bumps

Much has changed for California since the last UCLA Anderson Forecast at the end of last year. Economists are expecting California’s unemployment rate to rise slightly to 4.5 percent in 2019 from its 4.2 percent in January. But it will dip back down again in 2020 and 2021 to 4.3 percent.

One thing that has changed in California is home prices beginning to decline since last June. According to the California Association of Realtors, the median price for existing single-family detached homes fell at a 15 percent annual rate between June and December. “Clearly home prices are falling in California, and the decline is widespread and substantial,” wrote Jerry Nickelsburg, director of the UCLA Anderson Forecast.

While demand for housing continues to be strong in California, there is some reluctance for buyers who are afraid to commit to buying a home with talk of a slowing economy, interest rates peaking and memories of the recession when housing prices plummeted.

“It is pretty clear that buyer expectations have changed, and we don’t have any clear data on why they changed,” Nickelsburg said. “But there is certainly in the news media concern about where we are in the business cycle. Buyers have clearly pulled back.”

Consequently, housing starts will be down in California for 2019 and 2020, affecting the construction industry, and headed back up in 2021.

Despite a slowing economy in California, there will be employment growth as payroll jobs are expected to grow 1.8 percent this year, 0.6 percent next year but at a very slow 0.1 percent in 2021.