RETAIL

2018 Retrospective: Retail Vacancy Is Low but Business Is Not Easy

Even though bricks-and-mortar retail is supposed to be dead, retail-real-estate vacancy rates in Los Angeles County are low.

In the third quarter of 2018, vacancy rates dipped to 5.1 percent compared with a 5.2 percent vacancy rate last year, according to CBRE, a real-estate services and investment company.

Los Angeles’ vacancy rate is a far cry from Manhattan’s, where a survey by the Douglas Elliman brokerage found that 20 percent of the borough’s storefronts were vacant this year.

However, the commercial real-estate business is no cakewalk, said Jay Luchs, vice chairman at Newmark Knight Frank.

Challenges from digital businesses are continuing to take a toll on bricks-and-mortar, he said. Also, in the last few years, there’s been a trend of many retailers not signing leases that ask for top-dollar rents. “There is a universal pushback. It’s a different time. Fewer retailers are doing deals,” he said.

Fewer retailers making deals may be the reason there are vacancies on popular retail streets such as Melrose Avenue in West Hollywood and Los Angeles’ Robertson Boulevard. Many emerging brands and retailers have chosen to start operations online before opening a bricks-and-mortar location.

Even with lower vacancies, prices have been coming down, Luchs said. Lower prices for retail space should pave the way for newer brands and retailers to make their way into the market.

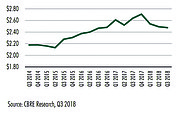

Currently, average rents on designer-district streets such as Melrose Place in West Hollywood are $15 per square foot per month. Rents on Rodeo Drive in Beverly Hills, Calif., can range from $50 to $75 per square foot per month, Luchs said. The average lease rate in Los Angeles County is $2.50 per square foot per month.

Derrick Moore, a senior vice president at CBRE, said he is seeing signs that retail real estate has shaken off some of the 2017 blues because online retailers, including Amazon Books, are opening physical spaces.

But the success of a space still depends on that real-estate motto: location, location, location. Consider the primary L.A. pedestrian hot spots such as Abbot Kinney Boulevard in the Venice area of Los Angeles and Rodeo Drive. “There is increasing demand in smaller areas that support higher rents,” Moore said.

A changing retail market made for some nontraditional stores moving onto retail streets and districts. In July, high-end resale shop The RealReal opened a 12,000-square-foot emporium down the street from Melrose Place. The online resale market Depop opened its first physical space in Los Angeles’ Silver Lake neighborhood in March.

New retail stores opening in Los Angeles in 2018 included high-end Japanese streetwear brand BAPE on Melrose Avenue near Robertson Boulevard. Japanese fast-fashion retailer Uniqlo opened a 12,000-square-foot shop at The Bloc retail center in downtown Los Angeles on Dec. 13, and the very exclusive Dover Street Market, which is located in only the best of urban areas, opened a few months ago in the Arts District of downtown L.A.