RETAIL

2014 Retrospective: Retail Sales: Urban Outfitters/Wet Seal

2014 has been a year of headlines for Urban Outfitters Inc.

The Philadelphia-headquartered company lived up to its hipster image when it announced in September that it is the largest purveyor of vinyl records in the U.S. (The claim was later rebuked by record executives and Billboard magazine, which say e-commerce giant Amazon.com sells the most vinyl.)

It stoked outrage in the same month when it stocked a blood red–stained Kent State sweatshirt, which it offered for $129. It quickly took the sweatshirts off the shelves after fielding critiques from people angry at the store for making light of the 1970 shootings at the Ohio university.

Financially, the specialty retailer’s most recent fiscal year started out well but ended with the top executives hoping that its Urban Outfitters division would perform better. The sometimes provocative company runs a fleet of 539 stores, which include nameplates of the more romantic Anthropologie, the bohemian Free People, wedding- and party-dress shop Bhldn, and home and garden store Terrain.

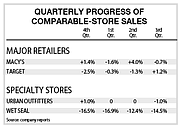

Urban Outfitters started its fiscal year by reporting good sales for its fourth quarter, which ended Jan. 31, 2014. Total company net sales increased to $906 million, or 6 percent over the same quarter the previous year. Same-store sales increased 1 percent. Richard A. Hayne, the specialty retailer’s chief executive officer, noted being pleased with the Anthropologie and Free People divisions. However, he was cautious on the performance of the Urban Outfitters division.

Fast forward to the beginning of the 2014 holiday season, Hayne had a similar story to tell investors. Anthropologie and Free People were doing well, but the Urban division needed work.

“I am disappointed by the results at the Urban Outfitters brand,” Hayne said in a statement. “There is much work to be done to improve the merchandise margins and store performance at the Urban brand, but I see positive signs as shown by strong results at the brand’s direct-to-consumer channel.”

2014 has been a tough year for the juniors business. On Dec. 4, Deb Shops, a Philadelphia specialty retailer, filed for bankruptcy. New York–headquartered Aeropostale reported Dec. 4 that its same-store sales had declined 11 percent for the third quarter of its fiscal 2014 year.

But business seems to have been particularly tough at The Wet Seal Inc. During a Dec. 10 conference call, Wet Seal executives announced that if the company could not resolve its liquidity problems, it could explore bankruptcy. For its third quarter, Wet Seal’s same-store sales declined 14.5 percent. Net sales totaled $104.3 million compared with $114.9 million in the same quarter the previous year.

The past few years for the company have been tumultuous. There was a bruising proxy battle that consumed the retailer in 2012. John D. Goodman, the chief executive officer, hired after the proxy battle, was fired in September and replaced by Ed Thomas, who ran the company from 2007 to 2011.

However Jeff Van Sinderen, a retail analyst for B. Riley & Co., forecasted that things will continue to be tough for the juniors retailer. On Nov. 17, he wrote a research note that downgraded Wet Seal’s stock to neutral from buy.

“Although every possible effort is being made by the much-improved [Wet Seal] leadership, those critical elements of the turnaround have not yet materialized,” he wrote.