Real Estate Vacancy Declining, Retailers Still See Opportunity

Business remains tough for boutique retail, but 2012 began on a bullish note for retail real estate for some boutique chains.

New York–headquartered boutique chain Intermix announced it will open two Los Angeles–area stores, one in Beverly Hills and another in the Brentwood neighborhood, in the next six weeks.

M.Fredric and Premier, both Southern California independent boutique chains, announced new stores, as previously reported in California Apparel News.

Premier announced March 14 that it signed a lease for a 5,100-square-foot space in Santa Monica Place in Santa Monica, Calif. (For more details, see Los Angeles Fashion Market coverage.) M.Fredric announced two new stores—one in Ventura, Calif., which debuted March 1, and another in Newport Beach, Calif., which is scheduled to open in May.

Retailers added new locations because of relatively high vacancy and real estate deals, not because of faith in the economy, M.Fredric’s Fred Levine said. “Real estate opportunities are abundant for established brands when there are so many vacancies,” he said in a recent interview.

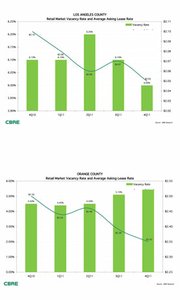

However, in Los Angeles County, commercial vacancy dipped at the end of 2012, according to research from leading real estate company CBRE. It’s part of a trend where landlords are growing more confident, said Jay Luchs, a CBRE executive vice president.

“The activity barometer is way up,” he said. “The prime streets are tightening up.” Landlords for the most popular spaces are increasingly choosing between multiple offers.

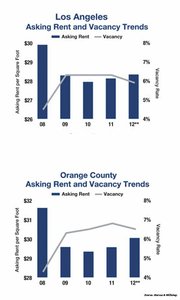

CBRE research shows that rates for asking prices are decreasing in Los Angeles and Orange counties. However, Luchs said a mix of high and low prices could be encountered on the same street. On Robertson Boulevard, one of Los Angeles’ prime retail streets, some recent deals have been made at $10 per square foot and others at $17 per square foot, depending on criteria such as the size of the space.

Asking prices are increasing at a solid rate—$2 on some Los Angeles streets. “Everything is going up. They’re not jumping with crazy levels,” Luchs said.

But retail real estate’s situation might change. Research from Marcus & Millichap, another leading real estate company, forecast vacancy increasing in 2012. —Andrew Asch