Last-Minute Back-to-School Sales Spur September Rally

Consumers waited until the last minute to shop for back-to-school apparel in September, helping some retailers realize a boost in sales early in the month. But bad economic news and unseasonable weather kept the retail sales reports mixed overall.

“The month benefited from late back-to-school shopping, with some apparel shopping pushed back from August to September as parents postpone fall and winter purchases until the cooler weather arrives,” said Michael McNamara, vice president of research and analysis for MasterCard Advisors’ “SpendingPulse.”

According to “SpendingPulse,” U.S. apparel sales were up 3.8 percent in September, which was the second-largest year-over-year gain for the category. E-commerce sales were up even higher, according to “SpendingPulse,” which reported a 13.4 percent increase in apparel sales.

Michael Niemira, chief economist for the International Council of Shopping Centers, said that U.S. retail sales on average grew 2.6 percent. Sales were slowed by hot weather, he wrote. However, sales for luxury retail grew 6.6 percent in September. He said consumer confidence in high-income households has been charting higher recently.

Still, September’s earliest reports indicate the market remains fragmented. “We believe September started off strong, driven primarily by BTS and Labor Day weekend promotions, but it fell off quickly after the holiday weekend ended,” analyst Liz Pierce, with Roth Capital Partners, said.

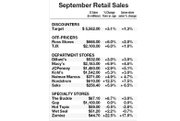

Discounters and department stores did well in October. Ross reported earnings of $666 million in September. Macy’s and Nordstrom reported same-store-sales increases of 4.8 percent and 7.5 percent, respectively.

Specialty stores showed mixed results. Even a late back-to-school rally couldn’t bolster City of Industry, Calif.–based Hot Topic, which saw its comp sales decline by 2.6 percent. Foothill Ranch, Calif.–based Wet Seal showed a decline of 0.7 percent. Everett, Wash.–based Zumiez continued its hot streak with a 17 percent increase in same-store sales. But San Francisco–based Gap Inc.’s September same-store sales were even compared with the same time in the previous year. —Alison A. Nieder and Andrew Asch