Now's the Time to Shop for Commercial and Retail Space

Los Angeles County rents for everything from offices and warehouses to retail space are at their lowest point in years.

“No matter whether you are looking for office or industrial space or retail space, it is a tenant’s market,” said Jack Kyser, founding economist of the Kyser Center for Economic Research at the Los Angeles County Economic Development Corp.

Retail spaces on some of Los Angeles’ most coveted shopping streets have declined by as much as 35 percent from a few years ago, with average rents down 10 percent to 15 percent from last year.

On Robertson Boulevard—home to such stores as Kitson, Lisa Kline and A/X Armani Exchange—rents have held steady recently but dipped considerably from nearly three years ago, said Philip Klaparda, senior associate at Dembo Realty in Beverly Hills. “Rents on Robertson have fluctuated so much,” Klaparda said. “But right now the rents are probably even with last year.”

He noted that rents are running at about $16 a square foot. During the shopping area’s heyday in the summer of 2007, rents zoomed up to $25 a square foot.

With cheaper rents, Robertson has only a few vacant storefronts. At the end of February, AG Adriano Goldschmied, purveyor of premium denim and other items, closed its space at 107 S. Robertson Blvd. while Lisa Kline consolidated two Robertson Boulevard stores into one.

Robertson may be on a roll, but Melrose Avenue is another story. Vacancies on the street are running at about 10 percent to 15 percent. “I would say it is kind of struggling,” Klaparda said. “Overall, rents are down from a year ago, about 10 percent.”

Rents range from $5 to $6 a square foot on the higher end of Melrose Avenue, between La Cienega and Crescent Heights boulevards, to $3 to $4 a square foot east of Fairfax Avenue. “However, we’ve seen a high level of activity and inquiries in the last month,” Klaparda said.

In contrast to Melrose, very little has changed on pricy Rodeo Drive in Beverly Hills. Rents still hover around $30 to $35 a square foot, and there has been little movement in recent months. “For being high-end luxury, it isn’t doing so badly,” Klaparda observed.Challenging commercial

In the past year, Southern California’s commercial real estate market has taken a beating due to zealous overbuilding and the economic downturn, which forced many people to either close shop or shrink their businesses.

In Los Angeles County, the office vacancy rate inched up to 16 percent during the fourth quarter of 2009, compared with 12.2 percent during the same period in 2008, said the LAEDC’s Kyser.

Consequently, office rents were down 11.4 percent during the fourth quarter of 2009 compared with the same period in 2008.

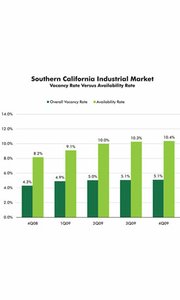

When it comes to industrial space, such as warehouses, the vacancy rate in Southern California crept up to 5.1 percent during the fourth quarter of 2009 from 4.3 percent during the same period in 2008.

Lease rates have slipped to 48 cents a square foot during the fourth quarter of 2009 from 55 cents a square foot during 2008, according to CB Richard Ellis, a commercial real estate brokerage headquartered in Los Angeles. But that may change.

“You are starting to hear more signs that at least the industrial market is picking up a little bit,” Kyser said. “Businesses are encouraged by what is happening at the ports.”

Activity at the ports of Los Angeles and Long Beach started to see signs of life in December after more than a year of declines. The Port of Long Beach saw cargo-container traffic jump 17.4 percent during the first two months of this year compared with last year while the Port of Los Angeles experienced a 9.74 percent increase in cargo containers coming through its docks. Receiving more imports means more demand for warehouse space.

But the commercial real estate industry is still in a precarious situation. With low lease rates and high vacancy rates, commercial real estate companies are being squeezed with debt.

One of those is Los Angeles commercial landlord Maguire Properties Inc., which recently sold an office complex in Santa Ana, Calif., for $90 million to help the company reduce its heavy debt load.

“Everybody is nervous about what is going to happen in the non-residential real estate market this year because you have a lot of loans that are coming due and people are wondering if they can roll them over,” Kyser observed. “A lot of the non-residential real estate loans are held by smaller banks. So you have a lot of people in the financial regulatory agencies worried that the smaller banks might be taken down.”