New York Textile Shows Highlight the Supply Chain

NEW YORK—The textile side of the apparel supply chain—from fiber and yarn to finished goods and sourcing opportunities—rolled into town recently for a series of trade shows focused on fabric.

Events kicked off on July 13 with Texworld USA, Messe Frankfurt’s textile trade show, and Kingpins, the premium-denim sourcing show organized by Olah Inc.

On July 14, Premiere Vision Preview, the New York sampling of the giant Premiere Vision show in Paris, opened its two-day show featuring European mills and trim suppliers at the Metropolitan Pavilion and Altman Building.

Consejo Intertextil Espanol, the European Regional Development Fund and the Spanish Institute for Foreign Trade teamed up again for the fourth edition of Textiles From Spain, showcasing the latest collections from several Spanish mills. The mills exhibited at PV Preview but also were showcased at a cocktail party at the Gabarron Foundation Carriage House Center for the Arts in New York's Gramercy Park neighborhood.

The shows concluded with SpinExpo, the New York edition of the Shanghai-based yarn and fiber show. Also held at the Metropolitan Pavilion and Altman Building, the show ran July 19shy;–21.Texworld adds sourcing and home textilesThis season, Texworld co-located with two new shows, the International Apparel Sourcing Show and Home Textiles Fabric Sourcing Expo, which were held side-by-side at the Jacob K. Javits Convention Center.

Los Angeles knit mill Mansfield returned to Texworld for the second time with a specific goal in mind—to find three or four potential new customers “that are brand names—and have credit,” said Warren Zaretsky, Mansfield’s vice president of sales. “The last show, I had three new customers. This show, I could hit eight or nine.”

Zaretsky was showing in the Lenzing Innovation Pavilion, organized by the Austrian fiber maker and owner of the Tencel and Modal brands.

Mansfield knits, dyes and finishes its products in Los Angeles. Originally targeting the juniors market, the company now works with contemporary and better brands.

Fessler, the Orwigsburg, Penn.–based maker of knits and knitwear, was equally enthusiastic.

“The last show, we got a lot of good leads,” said Brian Meck, Fessler’s vice president of sales and marketing. “This show, in the first four hours, we have more than 30 people come in and go through the line. And lot of the people had been companies we’ve been targeting.”

Enthusiasm continued throughout the three-day show.

“Yesterday was quite busy,” said Tina Lee, assistant general manager of the marketing division of Shenzhen, China–based yarn maker Huafu. Lee said she met with Old Navy, Adidas and United Kingdom–based Next at the show—“and Uniqlo this morning,” she said on the last day of the show.

Huafu specializes in meacute;lange yarns.

“It’s our only product,” Lee said. “Our mission is to be a specialist in color, design and R&D.”

Huafu has more than 1 million spindles and produces 28 million pounds of yarn per month. In addition to cotton, Huafu makes heather yarns in recycled polyester, recycled cotton and Lenzing products, including Tencel; Modal; and Viloft, the company’s new thermal fiber. “In winter, people don’t want something heavy to keep warm,” Less said. “[Viloft] is a good price point and a good replacement for cashmere.”

San Francisco–based J.N. Zippers & Supply Corp. was among the first-time exhibitors at the show. The family-run company has a factory in China and an office in Hong Kong and operates a warehouse and its corporate offices in San Francisco.

The J.N. Zipper booth was consistently busy, with buyers stopping by to see the latest product, including paper zippers and disposable zippers for the medial market, high-end zippers with customized printed and novelty tape.

Manning the booth was J.N. Zippers Sales and Marketing Manager Judy Elfving and sales rep Claudia Magness, who is based in Los Angeles.

“New York is corporate,” Magness said, describing the difference between East Coast and West Coast trade shows. “L.A. is fun and funky and more of a design center. But I’m from L.A., so I’m biased.

In the International Apparel Sourcing section, buyers browsed among the offering from factories in China, India, Pakistan, the United States, Bangladesh, Nepal and Kenya.

Sameer Hanik, head of sourcing for Algodon Sourcing, was manning the Irfan booth for the Karachi, Pakistan–based factory.

“We’re a niche product, and this show is to have a presence,” Hanik said, adding that there were “major and potential opportunities” at the show, but he won’t know how serious they are “until we have an order in hand.”

“A lot of the work is done afterwards to build from the ground up,” he said, adding that exhibiting at sourcing shows also gives international factories an opportunity to see where they stand in relation to the competition.

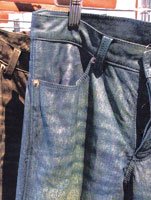

“We get to see what we lack in price or product,” he said. New exhibitors, product and sponsors at Kingpins Kingpins, the denim sourcing show organized by Olah Inc., kicked off its New York run on July 13 with a lineup of fiber and fabric makers, trim suppliers, factories and washhouses.

This season, the show also had a new sponsor, Invista. The fiber maker and owner of the Lycra brand was highlighting a few of its fiber innovations specially suited for the denim market, including Xfit Lycra, a two-way stretch fiber. Two of the exhibitors at Kingpins—Central Fabrics and Tavex Corp.— are licensed to use Xfit. Invista was also highlighting its super-stretch T400 fiber and its heavy-duty Cordura fiber, which is well-suited for the workwear and skate markets.

“Yesterday was really good,” said Kit Black, apparel marketing account director for Lycra. “It is a great show because it is so close-knit and very personal exhibition. When visitors come in, they spend a lot of time here. Yesterday, three girls from J. Crew stayed all day.”

Indeed, the show drew designers and representatives from many well-known brands and labels, including Club Monaco, Perry Ellis, Polo Ralph Lauren, Evisu, Helmut Lang, Victoria’s Secret, Chico’s, Lily Pulitzer, Land’s End, Sears, Coldwater Creek and VF Corp.

“Yesterday was a record for us,” said Kingpins founder Andrew Olah. New exhibitors this season include Grubig Internatioank Co. Ltd. from Korea, Dynamo from Turkey, Blue Farm Fashion Ltd. from Italy and China, Seaphone Textile Ltd. from China, and Invista. Olah was particularly enthusiastic to have Invista on board, citing the company’s expertise with stretch fibers and denim.

“They teach me something on a regular basis,” he said.

Grubig International was showcasing high-end leather that has been treated to look like denim. The Korean company operates a facility in China, where leather is washed, printed, garment-dyed, garment-washed, degraded to give an ombreacute; effect, distressed, edge cut or perforated, explained Ho S. Hong, president and chief executive officer. Leather pieces can be hand-painted or printed with different colors to give a worn denim look or printed with reflective paint.

Several exhibitors said the opening day was busy, but traffic was off in the morning on July 14 because of a sudden heavy shower of rain.

“The first day was good; the second day was slow because of the rain,” said Felix Dias Abeyesinghe, business development manager for the Melbourne Textile Washing Plant Ltd. in Sri Lanka.

“We are the largest wash plant in Sri Lanka,” said Abeyesinghe, “and one of the largest in SE Asia.” The company employs 1,000 people and produces 150,000 units per day. Melbourne operates two facilities in Sri Lanka and one in Jordan.

“We do wet and dry processing,” Abeyesinghe said. “We have everything in-house.”

Although 60 percent o the company’s business is in the United States, this was the first U.S. trade show Melbourne had done. Abeyesinghe first learned about Kingpins when he attended the trade show’s recent debut event in Hong Kong.

“I was in Hong Kong for other meetings when Kingpins was in Hong Kong,” he said. “We realized it’s a good customer base.”

Founded seven years ago, Blue Farm operates a design studio on Italy and a mill in China, where they produce denim and shirting fabrics. This season’s looks include sateen denim, high-elastic and non-stretch denims, slubs and ringspuns, color-weft denim, and rope-dyed indigo shirting fabrics.

The mill participated in the recent Kingpins show in Hong Kong prior to showing in New York, said Christopher S. Price, director of marketing and sales. Price said he first learned about the show in Los Angeles, which he attended when he worked for West Coast labels Gap Inc. and Quiksilver.

“It’s a different vibe here,” Price said, describing the New York show as a “high-traffic show.”

Marcus Fung, sales manager for Seaphone Textile Ltd., also learned about Kingpins in Hong Kong.

“My customers and friends recommended I do this show,” he said.

Seaphone is a family-owned company founded by Fung’s grandfather in Hong Kong. In 2005, the company opened a facility in China, where they weave, dye and finish the fabric. Today 80 percent of the company’s fabrics are made in China, with 20 percent manufactured in Hong Kong for quick-turn orders.

The company has customers Europe, Japan and Hong Kong, but the United States represents 50 percent of their business. Among Seaphone customers are Tarrant Apparel, Guess? Inc., VF Corp., Jordache and Jones Apparel Group, Fung said. PV puts the spotlight on Europe

Premiere Vision returned to New York for the July 14–15 run of its Premiere Vision Preview show at the Metropolitan Pavilion and Altman Building.

The show drew 3,216 visitors—a 7 percent increase over last year—including representatives from 3.1 Philip Lim, Rachel Roy, Nanette Lepore, Elie Tahari, Theory, Polo Ralph Lauren, Calvin Klein, Donna Karan, Ann Taylor, Talbots, Nine West, and Nordstrom, according to organizers.

With its mix of European textile mills and trim suppliers, PV Preview offered attendees a snapshot of the trends from Europe.

“In our global network, Paris is the backbone,” said Philippe Pasquet, Premiere Vision chief executive officer. “That is the place where we have the broadest offering and the fashion seminars. The idea of Premiere Vision Preview is to bring to America something in advance.”

For PV Preview exhibitors, the show offers a chance to meet with the American market—particularly with customers that may have skipped the main Premiere Vision show in Paris in recent years.

“We want to invest in this show because it is a gateway to the market,” said Michele Vigano, representative for Seterie Argenti SpA, based in Como, Italy. “People need freshness; they need new things. The afternoon [of July 14] was busy; we saw good names—which is important.”

Vigano said he saw designers from New York, Los Angeles, Chicago and the United Kingdom. And while many were still price-conscious, he said, the mood is improved over last year.

“There is a little bit of optimism compared with last year,” he said. “Last year they were complaining that the exhibitors were showing the same things. This year, they feel there are seeing new things and it makes them want to invest.”

Heather Maldonado, co-owner of Studio Bert Forma in Los Angeles and New York, said she saw several West Coast companies, including C&C California, Laundry, Tadashi, Seven For All Mankind and Guess.

Maldonado was representing several European collections at the show, including Reynaud Rexo and Philea, both based in France.

Reynaud Rexo’s Fabien Sicamois was pleased with the caliber of customer shopping the show.

“We’ve seen good customers, which is important,” he said. “We’re in a kind of niche market. For the last two years, the show had been good because [the buyers] always come. We must not be afraid to bring something special. When something is special, they know they can sell it.”

Pierre Schmitt, director of Philea, agreed. Schmitt recently acquired French corduroy and velvet mill Velcrex and is planning to add new fibers and new fabrications to the collection.

“We have a large experience in silky [fabrics with Philea],” he said. “In the past, there was not a lot of novelty in corduroy. We are trying to take corduroy and make it exciting by adding new fibers—even linen. We have to go back to our roots and redefine it with a new vision.”

For Portuguese mill Gierlings Velpor S.A., the point of difference is technique, trends and rapid response.

The mill manufactures “three-dimensional product,” explained Joao Teixeira Duarte, Gierlings Velpor’s commercial director, including high-end faux furs and velvet fabrications.

“We are investing in stock [goods] to respond as soon as possible,” Duarte said. “We want to work with our retail companies because they renew their collections each month.”

Duarte said most of GierlingsVelpor’s U.S. business is with East Coast companies—something he hopes to change.

“There are two main hubs in the United States—California and New York,” he said. “The main business we do in the United States is in New York, but we want to expand business to California.” Pasquet said higher-end manufacturers seem to be faring well and many of the mills are reporting modest to strong gains over last year. But challenges remain.

“Due to the crisis, the hole was really deep for the silk producers coming from Lyon,” Pasquet said. “Certainly, the worst is behind us. There are good [economic] signs and some more concerning [signs].

Pasquet noted that the industry still faces challenges such as the credit crunch and the shifting exchange rates.

“The devaluation of the exchange rate is good for the products we represent,” he said. “It helps in the short term, but it’s difficult for the players in the industry to bet on certain exchange rates. It’s difficult to make a forecast when the ground is not secure.”Spotlight on SpainThe July 14 Textiles From Spain exhibition featured cocktails, tapas, live music and textiles. On display were a sampling from 27 Spanish mills, including denim by Folgarolas Textil, novelties and jerseys by Texdam, sweater knits by Hilaturas Miel, jerseys by R. Belda Llorens, and swim fabrics by Ritex. SpinExpo’s focus on fiber and yarnThe last show of textile week in New York focused on the first part of the supply chain—yarn and fiber.

Founded eight years ago in Shanghai, SpinExpo’s China show features nearly 200 exhibitors from 16 countries, including fiber manufacturers, knitters and circular knit machinery manufacturers, spinners, and trend forecasters. The second edition of the New York Show, held July 19–21, featured a sampling of the Shanghai show’s scope.

“In Shanghai, there are 200 exhibitors and 9,000 visitors,” said show director Karine Van Tassel. “In New York, there are 78 exhibitors and 3,000 visitors. We want to bring in as much information and train them and make them salivate for more. In Shanghai, we offer catwalks and seminars. They come like sponges and absorb it all.”

The show featured a trend forum curated by Sophie Steller, a designer who worked for U.S. brands such as American Eagle and Joseph Abboud before opening her own knit studio and consultancy in London.

Steller was brought in to create the trend forum in Shanghai and re-created the concept for the New York show.

Using SpinExpo exhibitors’ fiber and yarn, Steller designed pieces that were displayed in trend vignettes, hanging from the ceiling or draped across a table. “I like the idea that you experience the trend,” she said.

The trend forum allows show organizers to demonstrate the diversity of the exhibitors at the show.

“The fiber is really extraordinary,” Van Tassel said. “We show the buyers what they can do with the yarn. Yarn is what makes the fashion more modern. Technique is what takes you into the next century.”

Among the exhibitors was one from California—Andari. This was the first time at SpinExpo for the El Monte–based knit mill, which also has a facility in Canton, China, for large-scale orders.

Lillian Wang, Andari’s president, said she wanted to exhibit at SpinExpo to scout for East Coast business—but the show turned into a reunion of sorts, where she became reacquainted with designers and suppliers.

“The show is very good, and I already met a lot of customers and a lot of suppliers from Italy who I used to know,” she said. “The knitting side of the industry is a small community.”

Wang said Andari was having a good year. “The orders are coming in,” she said. “We are the only company that can produce in the U.S.A.”

Another domestic company, spinner Huntington Yarn Mill, based in Philadelphia, was also on the hunt for new business.

The family-owned company manufactures novelty yarns and metallics and operates its own dyehouse. Among its past customers is St. John Knits.

“It’s good exposure for our company,” said Fay Jaraha, vice president of marketing for Huntingdon Yarn Mill. “There aren’t many yarn shows left in the United States—and, since we are in Pennsylvania, this is convenient for us.”

In addition to supplying yarn for apparel makers, the company works with furniture makers and companies in the craft industries. And because they own their own dyehouse, they can fill small orders.

One of the busier booths at the show was the one shared by Woolmark and Australian Wool Innovation Ltd., where the latest developments for wool were on display.

“People always have the perception of wool as itchy and scratchy,” said Edwin Nazario, senior vice president of the Americas for Woolmark.

Among the developments was Merino Touch, a program designed to showcase Marino’s variety of hand.

“We are trying to demonstrate the ranges of touches you can get from Merino,” said Roy Kettlewell, AWI’s global manager for knitwear. “Merino is a good alternative to cashmere.”

The Merino Casual was created to highlight wool as an option for the casual market. Among the garments were pieces in boiled wool made from a blend of treated and untreated fibers that gave the finished product a soft hand, good stretch and recovery and the ability to be machine washed.

“Merino fiber is very flexible; you can create some amazing effects,” Kettlewell said.