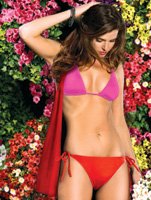

Waterwear 2011: Faster Fashion

Swim makers are looking to beat the competition with new trend-right—and price-right—capsules and collections.

The recession may technically be over, but swimwear makers are still looking for fresh opportunities to lower prices and increase volume—without compromising their core brands. Retailers are asking for sharper price points to cater to trend- and budget-conscious shoppers who want chic swimwear without the cher price tag.

Diane Biggs, owner of the 17-store chain of Diane’s Beachwear stores, said she can still sell $180 swimsuits, but more and more customers are looking for a fashionable fix minus the sticker shock. “That isn’t to say I can sell just any $80 suit,” she said. “Customers are coming back this year, but they’re not compromising and buying a suit just because the price is right. It has to be special—a great print, good quality, the right look and fit.”

Swim designers and retailers, like contemporary apparel brands and retailers before them, are feeling the pull of fast fashion, Biggs acknowledged. Consumers have gotten accustomed to buying designer trends on the cheap and at lightning speed—and, increasingly, they are able to pick up a cute bikini at fast-fashion spots such as Forever 21, Charlotte Russe and H&M. Even big-box retailers such as Target and Kmart are earning kudos among shoppers for their on-trend, cheap suits.

As a result, whether shoppers at specialty swim stores have adopted a fast-fashion mentality or are still feeling the effects of the recession, they have raised expectations paired with contracted budgets. At the same time, swimwear makers and retailers don’t want to see their market share eroded by fast fashion or the still-struggling economy.

“Designers want more volume—and so do retailers,” Biggs said. The result: Swimwear makers are debuting a variety of capsules and collections that feature sharp price points and focus on fashion.Specialty take on fast fashion

Howie Greller, vice president of merchandising of Manhattan Beachwear, sees fast fashion’s take on swimwear and thinks he can do better. The result is Bikini Lab, a new in-house brand debuting for Spring 2011 that touches on a wide variety of trends and wholesales for $12 per separate.

“There’s a need right now for fast fashion. [Women] are used to shopping at [fast-fashion stores], and they are used to seeing very current fashion at great prices,” he said. “They need a swim brand that does the same thing.”

The collection will be “defined by ready-to-wear fashion trends,” Greller said. The first collection, which debuts in July at the SwimShow in Miami, will include bikinis inspired by military, streetwear, ’80s, feminine and rock-chick trends that are gracing runways and fashion magazines.

Bikini Lab, which will use Manhattan Beachwear’s considerable overseas sourcing and production resources as well as a team of in-house juniors swim and young contemporary designers, is expected to significantly grow the swimwear manufacturer’s market share. “There will be 10 to 12 groups [per season] with three tops and three bottoms per group. The collection will be sold as separates, and there will be a lot of hardware and embellishments,” Greller said. “Our [retail] target is everybody, anybody that wants fashion swimwear and wants to compete [with fast fashion].”

A fashion supplement

The designer swimwear collection Becca by Rebecca Virtue has built its name on a bohemian world-traveler aesthetic that leans heavily on high-quality hardware, intricate embroidery and scads of high-end details. Gary DeShon, vice president of Anaheim, Calif.–based Lunada Bay, which produces the line, said even the luxury swim market is feeling the pinch. While competing with fast-fashion is the last thing on the brand’s agenda, finding a way to sharpen price points and provide retailers and shoppers more options is a key concern.

To that end, in 2010 Becca launched Color Code, a capsule within the collection that features basic silhouettes in solid colors that merchandise back to the main collection. The colors and fabrics are the same as those used in the print- and embellishment-heavy core collection, DeShon said. “These are opening-price-point designs. They have no prints, no trim—they are meant to be an add-on,” DeShon said. Color Code bikini tops and bottoms wholesale for $13.50 to $19 each, putting retail prices for the capsule on par with those of contemporary brands. Becca’s core designer collection wholesales for $25 to $37.

The idea behind the novelty solids capsule is that a woman may want to spring for the pricier bikini top with all the design details but not want to pay $60 for the matching bottom or vice versa. Color Code gives price-conscious shoppers the opportunity to buy a matching set that straddles two price points. “It lowers the overall cost of the suit, makes it more affordable and promotes a sale,” DeShon said. So far, specialty swim stores and department stores have had a strong reaction to Color Code, he added, noting that one major department store bought into the collection in a big way, opting to carry a rainbow of Color Code bikinis.Fashion appeal, sharp price, quickly

Solo by Blue Water Design Group, a division of Apparel Ventures, is a play to cater to a fashionable but price-conscious shopper, said Jeff Pofsky, president of Blue Water. The division—which until now had focused on producing contemporary swimwear for licensees such as Trina Turk, ABS by Allen Schwartz, Puma and Rampage—debuted Solo, its first in-house brand, for Spring 2010.

“We saw a need in the market. We listened to our customers, and they were calling for that niche—fashion at a better price point,” Pofsky said.

Featuring an American, full-coverage fit and complemented by coverups and a handful of sportswear pieces, Solo wholesales for $20 to $30 for bikini separates, $40 to $50 for one-piece swimsuits and $30 to $40 for coverups.

“Solo isn’t an effort to compete with the Targets and Wal-Marts and fast-fashion stores,” Pofsky said, but he acknowledged that speed-to-market has been a big concern for Blue Water. “This year we’re working on a very quick calendar. Our speed to market is 30 days faster [than last year].” Timeliness in deliveries makes for freshness on the retail floor, which hopefully translates into strong sales—both for Solo’s and Blue Water’s licensed brands.

Retailers such as Macy’s, Everything but Water and Swim and Sport picked Solo up for its first season, and Pofsky said its early delivery, styling and price seem to have gotten the brand off to a good start. “We foresee Solo being a volume business for us. It will become very important.”