Retail Demand Slows, but Investor Interest Grows

Retail vacancies during the first quarter of 2009 continue to climb as falling home values and payroll cuts and employment layoffs have forced consumers to cut spending, resulting in pronounced vacancy spikes, especially among smaller neighborhood centers and specialty boutiques in peripheral locations.

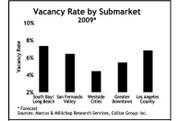

Real estate company Marcus & Millichap reported vacancy rates hitting a 10-year high in Los Angeles County, averaging6.8 percent during the first quarter. Absorption fell into the negative by 1.9 million square feet.

The lower rates have drawn new interest in investing as some are targeting assets with below-market rents, leased to strong credit tenants and with proven rent rolls. Marcus & Millichap economists project rents to continue falling to an average of $25.75 per square foot (triple net) by the end of the year, resulting in a drop of 4.8 percent. (Triple-net cost per square foot includes taxes, insurance and maintenance.)

In the San Francisco Bay Area market, closures of stores such as Shoe Pavilion on Market Street and the impending closure of a Virgin Mega Store in Union Square are indications the stability that San Francisco enjoyed last year is starting to falter.

Hotel room demand fell 12 percent during the first quarter, compared with a national average of 8 percent. Retail vacancies are expected to push up to about 4.8 percent, while rents are expected to drop 3.9 percent to $30.42 per square foot (triple net) this year, said Marcus & Millichap researchers. Retail jobs during the first quarter dropped 7.5 percent, with 7,100 positions cut in the trailing year period.

In Orange County, stores based near office space struggled because of employment cuts in the white-collar job sector. Retailers located near tourist attractions such as Disneyland also struggled but outperformed most sectors of the county. Many construction projects were being put on hold, though a Target store that is under construction in Brea should be delivered by the end of the year. Vacancies are projected to advance 7.2 percent, while rents should drop by 4.7 percent. —Robert McAllister