SIMA Releases Retail Study: Surf/Skate Down But Not Out

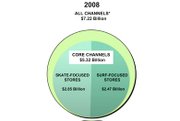

The Surf Industry Manufacturers Association released its “2008 SIMA Retail Distribution Study,” which estimates that the total surf/skate market reached $7.22 billion last year—down more than 3 percent from $7.48 billion in 2006. The core surf/skate industry—excluding company stores and mall-based chain stores—rang in at $5.3 billion, down 3.5 percent from 2006.

According to the study, skate-focused stores did $2.85 billion in business in 2008, while surf-focused retailers did $2.47 billion in business. The remaining $1.63 billion in sales is estimated to come from non-core distribution channels, including national department stores and mall-based chains such as Pacific Sunwear of California.

Doug Palladini, SIMA’s president and vice president of marketing for Vans, said the purpose of the study was to provide hard sales data to help core surf/skate brands navigate the market. “Culturally, the [surf/skate market] is research-averse,” he said. “Most of the people who start surf brands are surfers. They try to stay close to the consumer by living the lifestyle. We’re trying to add factual data into the mix.”

Footwear proved to be a highlight for the surf/skate industry in 2008, with a sales increase of nearly 16 percent over the study’s 2006 results. Accessories also saw an uptick, reaching sales of $561 million in 2008—an increase of more than 13 percent over 2006. Apparel sales reached $1.7 billion, down less than 1 percent from 2006, with surf stores posting $938 million in sales.

The report, prepared by Leisure Trends Group, shows that the surf/skate market fared better than most as the economy slumped, Palladini said. “While no one is immune to [the economy], the surf industry is poised better than most to ride it out.”

One reason the surf/skate industry saw only a 3.5 percent drop while other apparel sectors saw a free fall is that the surf/skate industry is fueled by consumers who participate in the sports. “People who surf will give up a lot of other things so they can surf. It’s an enthusiast pursuit, and that passion protects us and has put us in a better position than most,” Palladini said. “[Surf apparel and related goods] are not just like your favorite pair of jeans that you can live without.”

One challenge the surf/skate industry continues to face is the coastal nature of its business. Stores in the nation’s Western coastal region accounted for $2.5 billion, or 45 percent of all sales. East Coast stores accounted for 28 percent of sales. “That makes for both a challenge and an opportunity,” Palladini said. “It’s an opportunity to tell the story of beach culture everywhere and the challenge to push toward the middle of the U.S.”

The “Retail Distribution Study” comes as the surf/skate industry gears up for its trade show season. First up is the Agenda trade show, which runsJuly 22–23 and welcomes core and streetwear brands to its new location in Huntington Beach, Calif. Surf Expo will take place in Orlando, Fla., Aug. 20–22,and Action Sports Retailer Trade Expo will close out the season Sept. 10–12 in San Diego, Calif.