Credit Crisis Cuts Into September Sales

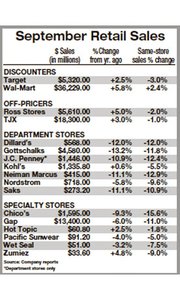

Retailers Nordstrom and JCPenney lowered their third-quarter earnings forecast as they reported lackluster September sales numbers this week. The revised earnings forecasts were the latest bad news for a month that was initially projected to be a decent, even if slow, period for sales.

New York–based International Council of Shopping Centers first projected sales for the United States’ retail sector in September would increase 2 percent. However, on Oct. 8, the ICSC found retail sales grew only 1 percent. “September was a very tough retail environment, with only a few bright spots,” said Michael P. Niemira, ICSC’s chief economist and director of research. “The economic background will continue to provide considerable headwinds in the coming months.”

JCPenney Chairman Myron E. Ullman, Nordstrom President Blake Nordstrom and Target Corp. President Gregg Steinhafel all blamed the historic problems in the financial markets for poor sales. “Sales for the month of September were below our expectations, reflecting daily volatility,” Steinhafel said in a prepared statement.

JCPenney, whose same-store sales in September were down 12.4 percent compared with the same period last year, said its third-quarter earnings would be in the range of 50 cents to 60 cents a share. Its previous guidance was 70 cents to 75 cents a share.

Nordstrom, which saw same-store sales decline 9.6 percent in September,reported that its revised third-quarter earnings would range from 32 cents to 37 cents a share, compared with its prior outlook of 49 cents to 54 cents a share.

Business seemed to be poor across the board. Dallas-based luxury store Neiman Marcus has historically reported solid performances. But in September, it reported a decline of 12.9 percent. Zumiez, a specialty retailer that typically has a strong performance, reported a 9 percent decline.

Wal-Mart Stores Inc. was one of a handful of stores to report positive same-store sales figures, with a 2.4 percent increase in September. —Andrew Asch