May Sales Better Than Expected

Despite increasing prices for fuel and food, retail sales had a strong showing in May.

U.S. chain-store sales rose by 3 percent, according to the New York–based International Council of Shopping Centers. The good performance took ICSC Chief Economist Michael Niemira by surprise. “May came in better than expected,” he said.

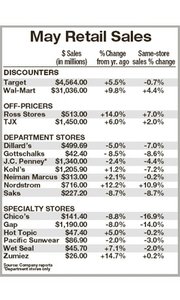

Niemira said the good performance was rooted in improved sales in the discount and drug-store sectors. Discount retail giant Wal-Mart Stores Inc. reported a healthy 4.4 percent same-store sales increase in May. Much of the boost was credited to consumers cashing tax-rebate checks at Wal-Mart’s free check-cashing services and then spending their money at the big-box discounter.

However, good news was not spread evenly across the retail front. May’s performance for department stores was poor. Popularly priced department stores tracked by California Apparel News reported declines in their same-store sales. Kohl’s sales were off by 7.2 percent. JCPenney’s sales dipped 4.4 percent, and Gottschalks’ sales nosedived 8.6 percent.

Luxury department stores also suffered in May. Neiman Marcus’ sales inched down 0.2 percent. Saks showed an 8.7 percent decline. Nordstrom was one of the few department stores with a spectacular increase—10.9 percent—in sales.

Retailers enjoying good sales in May typically offered fashions with low price points and designer looks, according to Jeffrey Van Sinderen, a retail analyst with Los Angeles–based B. Riley & Associates.

Foothill Ranch, Calif.–based The Wet Seal Inc. had mixed results. Its Wet Seal division focused on offering low prices and fashionable styles, which resulted in same-store sales going up 3.1 percent. Wet Seal’s sister division, Arden B, offered contemporary clothes with higher prices than Wet Seal did, and Arden B saw its same-store sales decline 1.7 percent.

Van Sinderen said business was looking up for specialty retailer Pacific Sunwear. Pacific Sunwear reported a same-store sales decline of 3 percent. But a reason for the decline was rooted in the retailer eliminating its sneakers merchandise, which began in early 2008. Same-store sales for Pacific Sunwear’s resurgent apparel division climbed 10 percent in May. —Andrew Asch