Economy Has the Apparel Industry Cooling Its Heels

With the winds of recession blowing over Southern California, many apparel makers and retailers are battening down the hatches until the economic outlook improves. Clothing makers and store owners are in a conservative mood, hoping for relief by the end of the year.

“I feel mall-based stores are just getting killed,” said Britt Beemer, founder and chairman of America’s Research Group in Charleston, S.C. “Traffic is down terribly. One lady I talked to said she goes to Wal- Mart and Target to save money and that she goes to the mall to spend money. That mindset makes the mall stores less attractive.”

For retailers, March was the cruelest month. The only winners in the same-storesales game were Costco and Wal-Mart Stores Inc., those big-box discount stores that offer prices on the low end. Neiman Marcus saw March comparable-store sales inch up a mere 0.4 percent.

However, the rest of the retail gang suffered. Chico’s, once an enviable success story that many chains attempted to emulate, came up short, showing a 20.7 percent plunge in March same-store sales. Gap Inc. wasn’t far behind, with an 18 percent tumble.

Consumers are definitely pinching pennies. In one of Beemer’s various consumer surveys, he discovered that more women are taking to the old-fashioned notion of making shopping lists before they hit the stores. “Normally one-third of women will make out a list before they go shopping. Now that number is 59 percent,” he said. “What that tells me when I walk into a store is that if I have four things on my list, I will walk out with no more than five items. If I walk in there without a list, I’ll maybe walk out with seven to nine items.”

And no one is expecting the government’s $168 billion in tax rebates to make a dent in the problem. Even though checks should start showing up in May, economists believe that only 20 percent to 40 percent of that money will trickle down to retailers. Financial observers note that banks have been bearing down heavily on consumers to pay off their credit-card debt, ramping up their bimonthly reminder phone calls to sometimes eight times a month. “Seventy percent of those rebates will go to pay debt, 10 percent will go for a romantic evening out and 20 percent will go toward retail,” Beemer noted.

Applying the brakes

Apparel manufacturers are feeling the brunt of the economic slowdown. With food and fuel prices rising, consumers’ dollars are committed to the basics in life. “Most of my clients are keeping tongue in cheek and looking at being more cautious,” said Bruce Berton, director of international business consulting and a long-time apparel expert at Los Angeles accounting firm Stonefield Josephson Inc.

He noted that if apparel makers don’t have a full purchase order for at least 3,000 items—the minimum order for many Chinese and overseas factories—they aren’t taking the deal. “It used to be that if they had an order for 2,000 pieces, they would leave 1,000 pieces as open-to-sell and say, ’Let’s go ahead with the order.’ Now they are saying, ’Hell, I don’t want to gamble.’”

Many firms are sticking to tried-and-true basic apparel, shying away from any outrageous fashion items that might get stuck on the shelf. “There is a back-to-basics business through the fall of this year instead of any fashion excitement,” Berton said.

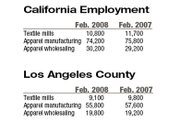

Uncertainty is ruling the economy right now. Housing prices have stumbled. Gas prices are creeping toward the $4-a-gallon mark, and jobs are shrinking. Some 80,000 jobs disappeared nationwide in March, mostly in the manufacturing and construction industries.

On top of that, no one is sure who is going to be in the White House in January. If a Republican wins, a more open free-trade policy will rule. If a Democrat steps in to the Oval Office, free trade might take a beating. Already, the U.S.-Colombia Free Trade Agreement is stuck in Congress with no sign of exiting. Democratic presidential candidates Hillary Clinton and Barack Obama have threatened to renegotiate the North American Free Trade Agreement with Canada and Mexico.

The ’stealth recession’

“It is going to be a tough year for the apparel and retail industry,” said Jack Kyser, chief economist at the Los Angeles County Economic and Development Corp., which tries to bring industries and businesses to the region. “If you look at the major industries in the United States, housing is in a depression. You have the U.S. auto industry struggling, and you have the retail sector going through a stealth recession because not too many people are paying attention to it.”

Some economists believe Los Angeles hasn’t dipped into a recession yet. Others believe it started at the beginning of 2008. Part of that is a hangover effect from the Writers Guild of America strike, which started late last year and lasted more than three months. Television and film production in Hollywood took a beating, with many projects sidelined until the strike was over. The Screen Actors Guild just started negotiations with Hollywood studios and television broadcasters. The American Federation of Television Radio Artists will hold seperate negotiations. Both their contracts expire June 30. “There is so much uncertainty out there that people are going to be very, very cautious,” Kyser said.

In Orange County, the economic picture is even worse. Several big-name subprimemortgage companies closed shop last year, throwing the region into a recession during the first half of last year.

In 2007, Orange County lost 5,900 jobs while Los Angeles County added 23,300. Many of those Orange County positions were well-paid workers making hundreds of thousands of dollars in the mortgage business. “When you go through a recession, income levels don’t grow as fast and spending is not as strong,” said Esmael Adibi, director of the A. Gary Anderson Center for Economic Research at Chapman University in Orange, Calif.

Unfortunately, no relief seems to be in sight soon. “I think this picture is going to persist for the entire year,” Adibi said.

Beemer, of America’s Research Group, is a little more pessimistic. “I think it will end Memorial Day next year,” he said. “I think we have 14 months to go.”

Berton, at Stonefield Josephson, foresees a turnaround popping up around the Holiday season. “By the fourth quarter, we’ll know who is going to be president,” he noted. “People will say, ’It’s cold outside. Let’s go shopping.’”