Modest December '06 Might Make Bright January '07

Retailers reported big sales during the last week of December. However, economists described sales growth during this crucial holiday month as moderate.

“More so than in past seasons, this holiday season came down to the week before Christmas, as consumers waited to the last minute to complete their shopping,” said Michael Niemira, chief economist of the New York–based International Council of Shopping Centers.

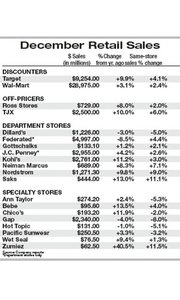

According to the ICSC, U.S. chain-store sales increased 3.1 percent in December, compared to the same time in the previous year. While this performance beat the ICSC’s forecast of 2.5 percent sales growth, the sales growth for the two-month holiday period of November and December was also modest. It grew 2.8 percent this year, compared to an increase of 3.6 percent during the 2005 holiday season.

Unseasonably warm weather was partially blamed for the sluggish sales. Consumers don’t want to buy outerwear when the sun is blazing, said Jeffrey Van Sinderen, a retail analyst at Los Angeles–based B.Riley & Associates. According to the ICSC, apparel chainstore sales declined 0.9 percent.

Van Sinderen also blamed the modest performance on changing modes of shopping. “You have more gift-card business, and the consumer has become so trained to look for bargains, they wait for merchandise to go on sale,” Van Sinderen said. The gift cards that are purchased are often not redeemed until January. While sales and promotions attract retail traffic, they can also grind down retailers’ margins, too.

One of the best-performing retail sectors were luxury stores, according to the ICSC. This sector’s sales increased 8.2 percent. Nordstrom was one of the best-performing stores, with comparative sales increasing 9 percent.

December sales were disappointing at The Gap. Comparative sales declined 8 percent at the giant San Francisco–based basics retailer, despite well-received holiday marketing campaigns. Chief Executive Paul Pressler said that the retailer’s Gap and Old Navy divisions would do some soul searching in the coming year.

“Given that we did not gain the traction we had expected, the management team, with the active involvement of our board of directors, is currently reviewing Gap and Old Navy’s brand strategies. We are committed to making the necessary changes to improve performance,” he said.

The outlook for January is bright. Niemira expected sales would grow more than 2.5 percent as consumers redeem their gift cards. —Andrew Asch