Chico's and the Woman

At various times over the past century, there’s been talk of the “new woman.” That time may very well be here again. For how else would you describe today’s woman over 40, who’s fit, trend-conscious, feels sexier than ever, and, like Demi Moore, might very well have a younger man on her arm?

You certainly wouldn’t call her “missy.” More than likely you’d call her a Chico’s customer.

“I don’t know if we have a word for her,” says Patricia Murphy Kerstein, Chico’s executive vice president and chief merchandising officer, of her target consumer. “She knows she’s not a teenager, but she has a very active lifestyle and doesn’t think of herself as an age, more as an attitude.”

Since 1983, Fort Myers, Fla.–based Chico’s has won tremendous customer loyalty—and enviable financial success—by offering a steady flow of products young in spirit but realistic in fit to customers with an average age of 52. In the process, Chico’s (NYSE: CHS), which went public in 1993, racks up some $1.5 billion in annual sales with four brands and 805 stores in 47 continental states, including 63 in California alone.

When it comes to sales per square foot, Chico’s is the queen of specialty retail. Companywide, stores average $1,000 per square foot, according to Liz Pierce, senior vice president and retail analyst for Sanders Morris Harris. “I can’t think of a retailer that does a thousand dollars per square foot,” she says. “Something like Bebe is still impressive at just below $700; Abercrombie & Fitch is maybe in the mid $400s.”

Staying acutely focused on the needs of the customer is the key, says Kerstein. “Our customer is comfortable with who she is. No woman thinks of herself as being old, and I don’t think any woman in the country walks into a store and says, ’Can you show me where your old section is?’”

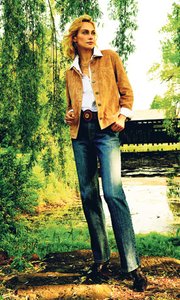

That doesn’t mean the Chico’s woman wants to wear Daisy Dukes, says Kerstein. “She wants to look current, sexy, and terrific, but she doesn’t want to look ridiculous. She’s definitely aware of trends and knows what’s happening and loves being pulled together.”

To this end, all of Chico’s merchandise is exclusive and designed in-house by the company’s product development team. “It’s all of us being focused, and not on what we say the customer wants, but on her and her needs,” says Kerstein. “It’s not about saying this is the trend and she’s going to buy it no matter what. We say, ’This is the trend and how do we do it for her?’”

Interpreting the trends—especially denim, which is an important part of Chico’s product mix—is an exacting science for the product development team. “For this customer, the fact that she can find denim that fits her is very important,” says Kerstein. “The customer has certain figure concerns,” she adds, “and it’s very frustrating to walk into certain retailers, especially those that address themselves to a younger customer, and go through the futility of trying to get a pair of jeans that fit.” The specs by company patternmakers have to be just right for rise and fit through the hips in order to flatter a realistic woman’s figure, Kerstein says.

“The most impressive thing is Chico’s ability to marry fashion with fit,” says Pierce. “And the product doesn’t look dowdy.”

To cash in on the premium-denim trend, Chico’s launched the Platinum collection, its highest-end denim group with a retail price of $78. “It’s premium designer denim,” boasts Kerstein. “We use nothing but the best quality, we use the same construction, and yet our price is terrific value.” Kerstein keeps the names of Chico’s denim manufacturers hush-hush but says the high quality and low price are the result of “a very good partnership with our vendors.” Chico’s vendors are located in the United States as well as many other parts of the world, and its denim is primarily made overseas.

“From the very beginning I heard such amazing things about the Platinum denim,” says Pierce. “And you have to believe it, since Chico’s continues to expand the number of items under Platinum.”

One California Chico’s store reveals denim offerings interspersed throughout the store and typically merchandised with complementary tops. The Platinum collection comes in a variety of blue washes, plus black denim and white denim. Most items include about 2 percent Lycra, and some have extra-wide waistbands to make the rise appear lower.

Many back-pocket designs feature a swoosh-like motif that is both contemporary yet subtle. A range of cuts is available, including a faded boot-cut jean with small distressed tears. The embroidery trend seen in the rest of the market is manifest in both dramatic and subtle ways, with one pair featuring a floral design running the entire length of one leg, and another dark-wash jean featuring smaller but colorful ethnic motifs. Even brass studs are offered as an embellishment.

But, according to Pierce, comp sales have been under pressure in the second quarter, and she believes it’s partly due to Chico’s actually downplaying its novelty denim.

Still, Chico’s customer loyalty is virtually legendary. In 1999, the company launched Passport, a club of which customers become members after purchases totaling $500. Members then receive a 5 percent discount, advance sales notices, free shipping, better catalog discounts, and various other perks. As of the first quarter of 2006, Passport counted 1.8 million members among its very loyal shoppers: They average six store visits per year with an average transaction of $119. Approximately 97 percent of Chico’s sales derive from charter and full-fledged Passport members.

Chico’s continues to sign up a high rate of new members, says Pierce, as well as convert them from temporary to full-fledged. And even if the customer buys a lot in the first couple of years and then drifts away, “she seems to bounce back in year four or five.”

Such loyalty is not easily won, and to reap this fidelity Chico’s offers almost endless newness along with value.

“We don’t want to put anything in our stores that doesn’t represent value,” says Kerstein. “There can be a $600 jacket in the store, but it can’t be worth only $400. She needs to see that it’s worth $800 or $1,200 at another retailer.”

One hot retailer, one hot stock

Chico’s has been as attractive to investors as it is to shoppers. While consumers are drawn to the novelty, investors like the steady growth, experienced management team, and a stable balance sheet boasting $407 million in cash with no debt. Indeed, between 1995 and 2005, Chico’s stock increased a staggering 17,600 percent, making it the second-largest earner among public companies in that decade.

For the fiscal year 2006, Chico’s the company (which includes its other holdings, White House/Black Market, Fitigues and Soma) plans a 30 percent increase in retail square footage, or 140–150 net stores planned. For 2007, there will be a 25 percent square-foot increase in 165–190 net stores.

For 32 of the past 36 quarters, Chico’s has had same-store sales at 10 percent or more. Also for 32 of the 36 past quarters, the company has seen an increase in net income of 30 percent or more.

Strategic acquisitions have helped build the company. Chico’s acquired White House/Black Market in 2003, Fitigues in 2006, and launched Soma, a line of intimate apparel, in 2004. The brands operate independently of the parent company.

Though Chico’s stock is currently trading near its 52-week low, Liz Pierce, senior vice president and retail analyst for Sanders Morris Harris, has a “Buy” recommendation on it. “A lot of people argue that the growth is behind them,” she continues, “but I still believe there is incredible square-footage growth, not as much at the main core business, but definitely at White House/Black Market and Soma.” With Soma, notes Pierce, there’s virtually no competition for intimate apparel aimed at baby boomers.