2006 Retrospective: Hot Boutique Market Drives Up Retail Rents

The proliferation of clothing boutiques and manufacturers entering retail has contributed to 10 percent to 20 percent jumps in rents in prime Los Angeles retail markets, said Philip Klaparda, an associate with real estate firm Dembo & Associates in Beverly Hills.

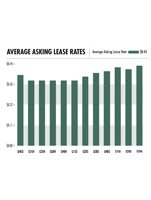

Rodeo Drive rents in Beverly Hills averaged $35 per square foot, an increase of between 5 percent and 10 percent over the past year. Other streets, such as Beverly Drive, are ranging between $12 and $15 per square foot, while West Melrose was averaging $8 to $10 heading into December, reported Dembo.

Robertson Boulevard rents were especially strong, growing up to 20 percent over the year and stabilizing at $15 per square foot in the fourth quarter.

“There are not a lot of vacancies in these areas. It’s been a strong year,” said Klaparda, who added that he saw more manufacturers open stores to capitalize on hot retailing as well as on brand building.

Orange County’s retail scene remained strong yet relatively flat with vacancy rates stable at 3.5 percent, reported CB Richard Ellis Real Estate. Yet average rents grew 6 percent to $2.49 per square foot. The mark was closer to $6 per square foot in north and central Orange County as well as the region’s central coast. Orange County has about 3.5 million square feet of retail under construction.

The Inland Empire’s population growth is expected to reach 4.4 million by 2011, making it one of the fastest-growing markets in the United States. The population growth has also led to more demand for retail, especially at the upper end. While Target and Wal-Mart have led aggressive expansions in the area, the success of the upscale Victoria Gardens shopping center in Rancho Cucamonga, Calif., has spawned other centers, including the recently opened Promenade Shops at Dos Lagos in Corona, Calif. Similar projects are on tap, with an estimated 15.4 million square feet of construction taking place. About 30 million square feet are in the planning stages.

Demand has forced vacancy rates down to 5.6 percent from 6 percent, according to CBRE. Rents have climbed to $1.74 from $1.50 over the past year.

Demand high for industrial spaces

Warehouse space in key manufacturing markets such as Vernon, Calif., in Los Angeles County has continued to be in high demand and is virtually sold out as the vacancy rate dropped to 0.3 percent at the end of the third quarter, reported CBRE. Overall vacancies in the county dropped 10 percent over the past year to 3.1 percent. The areas with the most vacancies were in the San Fernando Valley, which had a 6.1 percent vacancy rate. Lease rates increased to 63 cents per square foot from 58 cents over the past year.

Orange County rents have also been on the upswing, climbing to 98 cents per square foot from 81 cents for hightech space. Rents for manufacturing and warehouse space grew from 58 cents to 63 cents. Vacancies dropped to 4.9 percent from 5.8 percent for research and development and to 2.7 percent from 3.3 percent for manufacturing space.

The limited supply in Los Angeles and Orange counties has led many to the Inland Empire, where 23 million square feet of projects are under construction. As a result of the new buildings coming on line, vacancies actually grew to 3.2 percent from 1.5 percent from a year ago, according to CBRE research. Inland Empire rents, however, climbed to 43 cents from 40 cents. The region recently welcomed a new Target distribution center. —Robert McAllister