Falling Vacancies Push Up Rents for Warehouse, Retail Space

Apparel manufacturers, importers and distributors looking for warehouse and office space may not find the falling prices that are being realized in the housing market. Strength in international trade and limited availability of warehouses is keeping demand strong and pushing up prices and lease rates for industrial property in Southern California.

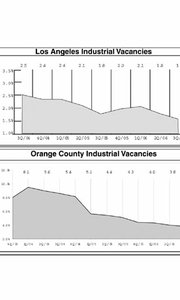

In Los Angeles County, where most of the industry’s domestic manufacturers are based, vacancy rates fell 20 basis points during the third quarter to a record low of 1.6 percent, reported Grubb & Ellis. Sale and lease activity hit 11 million square feet. Rents grew by 9 percent in the quarter compared to a year ago. Construction activity fell to 4.5 million square feet from 7.7 million square feet last year because of the land shortage.

Orange County’s industrial vacancies also fell 20 points to 3.8 percent. The market is home to many of the leading beach/surf brands, including Quiksilver. Net absorption during the quarter reached 760,000 square feet. As a result of the lower vacancies, landlords have been able to stay firm to their asking rates, offering few concessions, said Grubb & Ellis brokers.

The tight market has some looking to markets like the San Gabriel Valley, where there is a small but limited supply of sizable warehouse space. For larger needs, companies have been heading to the Inland Empire, where there are 24.3 million square feet of construction activity taking place, up 12 percent from a year ago, said Grubb & Ellis. The third-quarter vacancy rate leveled at 4.3 percent, up from 2.8 percent a year ago, and is attributed to the new construction. Net absorption was 7.2 million square feet, up from 6.7 million a year ago.

Grubb & Ellis reported that the Inland Empire set a record during the quarter for having the most projects—14—at 500,000 square feet or more under construction at the same time.

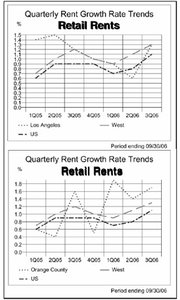

On the retail front, Los Angeles County rents grew by 1.3 percent during the third quarter, according to New York–based researcher Reis. Orange County growth was at 1.7 percent. The data were taken from community shopping centers, which are centers where retailers like Target, Wal-Mart, Ross Dress for Less and an assortment of smaller specialty stores are based.

The Inland Empire continued to show its topline growth with the introduction of more upscale retailers, noted Irvine, Calif.–based real estate firm Sperry Van Ness. As a result, rents have risen to $38 per square foot in desirable locations, up from $24 in 2003.

—Robert McAllister