Turnaround Experts Take On Outdoor Label

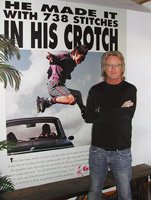

Marty Weening has the cool look of a beat musician or of an avant-garde painter. His hair is parted in the middle and tumbles toward his shoulders.

He rattles around his architecturally styled office in blue jeans and soft leather shoes that look more like slippers than sturdy shoes.

But Weening is a businessman, a garment veteran who in some ways is an artist. He’s a turnaround specialist who has been brought in to revamp the outdoor wear line called Gramicci, which fell on hard times when its parent company, Sole Survivor Corp., filed Chapter 7 bankruptcy in late 2004 after reportedly losing $7 million.

The company is now owned by Sole Assets Holding. Its major shareholder is Paul Buxbaum of the Buxbaum Group, a decades-old company in Calabasas, Calif., known as one of the largest liquidators and appraisers of retail inventories in the country. In recent years, the Buxbaum Group has taken to transforming financially ailing companies with big debt problems after being called in to liquidate company stock or help financiers get some of their money back.

Most recently one of those companies was Rampage Clothing Co., the Los Angeles junior apparel company that was close to filing Chapter 11 bankruptcy for the second time in six years. After a 2-year-old overhaul, the Rampage brand was sold last year to Iconix Brand Group Inc. in New York for nearly $46 million.

Now Buxbaum is trying to perform the same magic on Gramicci with Weening as its head wizard, working out of the company headquarters in Westlake Village, Calif., with a staff of slightly more than 20 people.

The job was not something that Weening had in his sights. He was running his own Los Angeles brand-management and consulting firm called Lucid Management. In July 2005, he was hired to do a brand assessment and five-year business plan for Gramicci. When he finished with that plan, Buxbaum asked him to stay on.

“I was a bit reluctant,” said Weening, who started his own menswear label in 1984 called Axis (which is now owned by Perry Ellis International in Miami) and had developed a menswear line for Cherokee Inc. in Van Nuys, Calif. “But then I got excited. I was thinking I might be able to do this one more time.”

So on Oct. 15, 2005, Weening was named Gramicci’s new president. He has been employing that five-year plan ever since, while hoping to do some licensing deals for items such as shoes, sunglasses and backpacks.

Brand recognition

At its peak in 1998, Gramicci’s revenues were $29 million. While Weening wouldn’t talk about current revenues, he said that Fall ’06 orders were up 40 percent over the previous year and Spring ’07 orders rose 65 percent.

“We found in our focus groups that the brand had an enormous and positive following in the outdoor market,” he said, which became obvious after talking to four focus groups set up in Los Angeles, Seattle, Chicago and Boston. “The company was getting 100 e-mails and phone calls a week from people asking where could they find it.”

Even outdoor retailers who had been disappointed by poor deliveries in the past seemed to be somewhat forgiving. In the past, Gramicci had been sold at REI, Whole Earth Provision Co., Eastern Mountain Sports, Paragon and Kittery Trading Post. Those stores returned to carry Gramicci, Weening said, now that deliveries are more than 90 percent on time. Bass Pro and Eastern Mountain Sports are among the company’s top vendors for the Spring line, Weening said. The company has opened at least 82 new accounts for its menswear line and 98 accounts for its womenswear line in the last year.

“Gramicci is one of the vendors we have because customers are actually looking for their products,” said Dionne Sirp, who works at the Mauka to Makai Outdoor Gear store in Honolulu. She said the quickdrying shorts and pants are particularly popular.

“They have a recognizable cult name,” said Bruce Berton, an industry veteran and director of international business consulting at Los Angeles accounting firm Stonefield Josephson Inc. “They are like a surfer label in their niche.”

But REI spokesman Mike Foley said the outdoor retail chain will not be carrying the men’s line in 2007. He would not say why that decision was made.

Gramicci has always had a small but true following among the granola-eating hiking crowd that embraced the label when it was founded by Mike Graham in 1982. An avid surfer and climber, he developed durable hiking shorts and pants that had a gusseted crotch for easy mobility and cinched waists. The fabric lasted forever but didn’t soften up until it had been washed dozens of times. Tops were as durable and comfortable as the bottoms with garmentdyed treatment. In 1998, Graham sold his share of the company, based in Oxnard, Calif., to his partner, Don Love.

Under Love, about 80 percent of production was done in Southern California. The rest was done offshore. But the red ink started to flow and Gramicci ended up owing CIT Corp. a sizable chunk of money.

That has completely changed with Weening at the helm. About 95 percent of sourcing is done in India and China now. The rest is done domestically.

Retail price points have remained about the same, with pants selling for $48 to $65, knit tops for $18 to $32, shirts for $40 to $50 and jackets for $65 to $85.

The men’s and women’s lines have been expanded considerably. Under Gramicci’s transformation, new designers have come on board. Sarah Mark, from Sanctuary, is head of the womenswear line. And Adriana Estrada is in charge of menswear.

The marketing campaign employs inhouse artwork that gives the label a slightly hippie feel. Weening describes the company as the “Grateful Dead” of the outdoor market.

Shifting the core

For Fall ’06, about 15 percent of the product mix stuck to the core basics that Gramicci has been known for. The rest were brand-new items that included new proprietary fabrics and finishes for a softer feel. Quick-drying fabrics were also added. All this brought a sense of hipness to the label to go beyond Gramicci’s original core customer, who lately had been over the age of 45. That group now makes up about 35 percent of customers. Another 35 percent are in the 25- to 45-year-old range, a consumer that wants a comfortable and cool item that is detail oriented for outdoor wear and everyday life. Weening said the Fall ’06 collection sold out.

Organic cotton and hemp made up 28 percent of the Spring ’07 line, whose campaign celebrating the company’s 25th anniversary was “Never the Norm.” The Spring line also added an antique Indonesian sarong print for things such as skirts and dresses, appealing to a younger generation.

On the horizon are more proprietary fabrics and finishes. Almost 40 percent of the Fall ’07 line will have organic cotton and hemp to appeal to the environmentally oriented customers and to keep retailers interested. It’s all about infusing a sense of newness into the label while keeping its core customers.

This injection of new silhouettes, fabric and finishes has kept the Gramicci staff on their toes. Meetings on an outdoor balcony overlooking a water garden help alleviate the quick-fire pace.

“This has been a whirlwind year, let me tell you,” Weening admitted. “This has been tantamount to creating a brand-new company.”