Easter Might Cure March '06 Blues

While families across the world celebrate Easter April 16, retailers hope the holiday will spur spending that will make up for the modest performances experienced throughout the market in March.

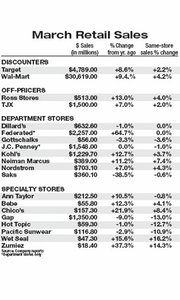

Retailers posted softer-thanexpected results last month— just a 1.9 percent increase compared to the previous year, according to the New York–based International Council of Shopping Centers.

Executives at companies as diverse as Target Corp., Gap Inc. and Ann Taylor Stores Corp. urged investors to consider April as the time to judge their companies’ true performance capabilities.

One of the main reasons for their plea is that this year Easter falls in April, and the holiday has traditionally boosted sales. For example, in March 2005, retail sales grew 4.1 percent because of the holiday, according to the ICSC.

Teen retailers, a sector that enjoyed booming sales for the past two years, were specifically hit hard last month. But sales skidded for many companies with typically high-performing records. Abercrombie & Fitch Co. reported flat same-store sales in March. Aeropostale Inc. and Pacific Sunwear Inc. showed declines of nine percent and 10.9 percent, respectively.

While other teen-oriented retailers such as Wet Seal Inc. and Zumiez Inc. reported high comps, 16.2 and 14.3 percent, respectively, the sector may been in for a period of more modest growth, said Michael Niemira, chief economist for the ICSC. Its March aggregate for teen retailers was down 2.3 percent, compared to being up 2.1 percent for the same time the previous year.

“The bad news is that the boom is probably over,” Niemira said. “Moderation ain’t bad. But it’s hard to live with after you’ve tasted boom times.”

Retail analyst Jeffrey Van Sinderen of Los Angeles–based B. Riley & Associates felt March’s generally poor weather was more to blame for poor sales at teen retailers than the end of a boom. Van Sinderen said teen retailers should remain a good bet because their customers’ revenue, earned from part-time jobs and allowances, is typically cushioned from economic turbulence.

“As long as [teens] can make money, they will have money to spend on clothing,” Van Sinderen said. —Andrew Asch