2005 Retrospective: China's Gains in Apparel Imports Comes at a Cost for Other Countries

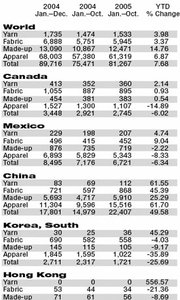

China was the king of the hill as the principal supplier of textiles and apparel to the United States in 2005. It now makes about one in four garments sold in this country. China exported $22 billion in textile goods to the United States during the first 10 months of the year, a 50 percent leap over the same period in 2004.

The principal reason for the surge in China’s exports was the elimination of apparel and textile quotas at the beginning of 2005 for all 149 members of the World Trade Organization. China joined the WTO in late 2001.

The country was poised to export more apparel to the United States, but U.S. manufacturers lobbied hard to get the Bush administration to impose temporary quotas, known as safeguard measures, on various items such as cotton shirts, cotton pants and underwear that had begun flooding the market early this year. The ability to establish safeguard measures until the end of 2008 was a condition of China joining the WTO.

While China thrived in 2005, Mexico struggled to maintain its position as the No. 2 supplier of apparel and textiles to the United States. Higher labor costs in Mexico have sent many U.S. importers to Asia in search of clothing factories that can get the job done at less than half of Mexico’s costs. During the first 10 months of 2005, Mexico exported $6.7 billion in textiles to the United States, down 6 percent from the same time period in 2004.

Mexico’s principal advantages for trading with the United States include geographic proximity and being a member of the North American Free Trade Agreement, established in 1994. Under NAFTA regulations, almost all apparel and textiles imported from Mexico enter without paying duties, which can range from zero to 32 percent of a good’s value.

Central America, which as a region has been the second-largest apparel and textile supplier to the United States, held its own in 2005. It exported $8.1 billion in goods during the first 10 months of the year. It is poised to remain a strong textiles supplier now that the Central American Free Trade Agreement has been ratified by all of the seven signatory countries except Costa Rica. —Deborah Belgum