Luxury and Hurricanes Make for Mixed September '04

September retail sales and forecasts for October ranged from bullish to soft. The mixed message stemmed from an American economy that was both reeling from hurricane damage in Florida and enjoying a luxury market that has been growing since the end of 2003.

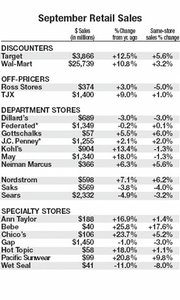

The general consensus among economists, however, was that September sales were generally flat. New York–based International Conference of Shopping Centers’ survey of 71 chain stores found that samestore sales were up only 2.4 percent in September, compared with a 5.9 percent gain last year.

Businesses reported a sales boost during the Labor Day weekend, but many retail chains reported that Florida’s hurricane season took a big bite out of their business. Cincinnatibased Federated Department Stores Inc. stated that sales declined 2 percent after hurricanes Frances and Jeanne.

But beyond the sales spikes and declines, economists such as Michael Niemira of the ICSC said September’s retail story was a familiar one. “The high end continued to do well, the low end continues to struggle, the middle part of the market was mixed,” Niemira said.

Bebe Stores Inc. was among the month’s winners. The Brisbane, Calif.–based retail chain beat the estimate of analyst Liz Pierce of the Los Angeles office of Sanders Morris Harris Group Inc. Bebe’s 17.6 percent same-store sales for September surpassed Pierce’s estimates of a 5 percent to 7 percent increase for that month.

Pierce also stated in a research note that Bebe was on target for a stellar Holiday season because the company had added more suiting options to its wear-to-work assortment and its signature denim line was competing well with other premium jeans.

Pacific Sunwear of California Inc., based in Anaheim, Calif., also experienced relatively high comparative-store sales of 9.8 percent. Pierce stated in a research note that PacSun’s Holiday looked bright because the company had presented an assortment of current fashion, such as woven shirts and denim, while maintaining a strong presence of popular activewear.

The increasing price of gas, at a record high of $54.60 per barrel for U.S. light crude oil on Oct. 14 and a weak jobs market has continued to worry consumers, according to Steve Spiwak, economist for Columbus, Ohio–based Retail Forward Inc. The company’s Index of Future Spending, based on consumer surveys, slipped to 100.7 for October from 102.7 in September. Twenty-three percent of high-end households surveyed plan to spend more this Holiday than they did last year, 75 percent of middle-market households plan to spend the same amount they did last year, and 32 percent of down-market households plan to spend less this year.

Retailer optimism is increasing according to the New York–based National Federation of Retailers. The federation’s executive opinion survey jumped seven points, partly because of retailers’ anticipation of good Holiday sales.

—Andrew Asch