Luxury/Specialty Stores Report Stellar October '04 Sales

October’s sales chased away the retail blues of September and August, and the companies with the right stuff to wipe out the sluggish business trends were luxury and specialty stores.

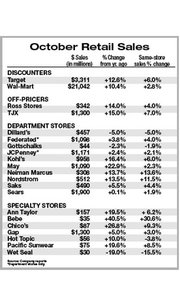

Sales at specialty stores and luxury retailers rose 9.2 percent, according to an index of 75 chain stores charted by the New York–based International Conference of Shopping Centers. The index’s overall performance increased by a strong 4.1 percent. It was the best sector-wide performance since May’s robust showing of 5.7 percent.

Specialty and luxury apparel stores took the lead in October’s race to profits because these stores are giving consumers what they want, said Michael Niemira, ICSC’s chief economist and director of research.

“I suspect what we’re seeing are better product offerings,” Niemira said of apparel in specialty and luxury stores. “That’s the key reason for underlying demand.”

Bebe Stores Inc. reported the best results of this sector. The Brisbane, Calif.–based contemporary womenswear store earned a same-store sales increase of 30.6 percent, compared with a 4.9 percent same store increase in October 2003. The company’s stocks surged 10 percent the day its sales were announced, but retail analysts such as Liz Pierce, senior vice president of the Los Angeles office of the Sanders Morris Harris Group Inc., have been bullish about Bebe for most of 2004. “We believe Bebe will stay ahead of the fashion curve and its peer group,” Pierce wrote in a research note in October.

The Neiman Marcus Group Inc. of Dallas also had strong sales, reporting a 13.6 percent increase in samestore sales for October.

Meanwhile, stores with popular price points reported either sluggish or poor sales. Bentonville, Ark.–based Wal- Mart Stores Inc. posted an anemic 2.8 percent same-store sales growth in October, and Little Rock, Ark.–based Dillard’s Inc. reported a 5 percent decrease. Niemira blamed the poor showing of moderate stores on the high cost of fuel.

Hot Topic Inc. was one specialty store that stumbled in October. Many retail analysts were surprised because Halloween has traditionally been the most important holiday for the City of Industry, Calif.–based retailer, which specializes in punk-rock and Goth clothes, said Jeffrey Van Sinderen, an analyst with Los Angeles–based B. Riley & Co. “I thought they were going to have a good Halloween,” Van Sinderen said. “Sales for their Halloween costumes category decreased 10 percent. But was it a disaster? No. The rest of Hot Topic’s business was what it was in September.”

The company’s efforts to tap into feminine fashion trends—albeit with the retailer’s signature Goth/rock take—appears to be working, Van Sinderen said. “The music business continues to be strong, and their ’Dark Romance’ campaign has done well,” he noted. —Andrew Asch