November '04's Sales Bring Mixed Yuletide Messages

The holidays could bring a lot of cheer to retailers but gratification might be delayed, said Michael Niemira, chief economist for the New York–based International Council of Shopping Centers.

Shoppers completed only 6 percent of their Christmas shopping by the last week of November, according to an ICSC survey. That’s good news because Thanksgiving weekend sales were slow despite a blockbuster Black Friday. These sluggish sales brought the month to a disappointing end.

December, however, should give retailers something to look forward to, including two extra days in the Holiday shopping calendar. Each of these days could add more than $750 million to retail coffers, according to Niemira. Another stocking stuffer may be the anticipated $32 billion dividend payout from Redmond, Wash.–based Microsoft Corp., which will be distributed in December. The payout could add half a billion dollars worth of Holiday cheer.

But in November, the majority of comparable-store sales figures released ranged from lackluster to moderately good, leaving retailers wondering if the high potential of December could be undercut by the uncertainties of the preceding month.

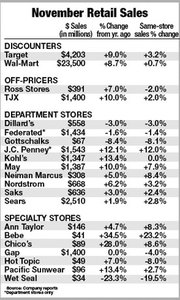

According to the ICSC’s chain-store sales index, retail sales rose by a meager 1.7 percent on a year-over-year basis. But the index also found that department stores and luxury markets had a good month, as overall sales in these categories increased by 2 percent and 5.2 percent respectively.

Dallas-based The Neiman Marcus Group Inc. continued a winning sales streak with an 8.4 percent comparablestore sales increase. Brisbane, Calif.–based Bebe Stores Inc. maintained a stellar same-store sales growth of 23.2 percent.

Other California retailers faced a tough November. Anaheim, Calif.–based Pacific Sunwear of California Inc.’s same-store sales growth dropped from 8.5 percent in October to 2.7 percent. San Francisco–based Gap Inc. dropped from 3 percent comparable-store sales growth in October to -4 percent in November. City of Industry, Calif.–based Hot Topic Inc. slid from a 3.8 percent same-store sales decrease in October to an 8 percent decrease in November. Both Hot Topic and Gap revised their fourth-quarter outlooks after reporting soft sales.

But help should be on the way, according to Niemira, who—along with economists from the Washington, D.C.–based National Retail Federation—forecast a strong finish to December.

January’s sales, however, might be traditionally soft after Holiday buying, Niemira cautioned. “There’s volatility ahead,” he said. —Andrew Asch