CBI Sourcing Show Attendees Hoping for New Trade Deal in 2004

GUATEMALA CITY—The buzz among Central American apparel and textile manufacturers these days centers on one thing: the hope that a new free-trade agreement will be in place with the United States next year.

“If we don’t have some kind of agreement in place, I don’t know how we can compete with China,” said David Cohen, sales manager for Texzibe, a 31-year-old Guatemalan textile company that manufactures yarns, as well as knitted and woven fabrics.

The apparel industry in Guatemala and in many Central American countries has been stagnant since the Sept. 11 terrorist attacks put a crimp in the U.S. economy and consumer confidence.

In the months following the terrorist attacks, 40 apparel plants in Guatemala closed their doors. Now, Guatemala is holding steady with 228 apparel factories, 48 textile mills and more than 200 auxiliary companies that employ 120,000 people. With the prospect of a freetrade agreement, Guatemala is hoping its apparel industry will burgeon.

Already, Texzibe is projecting its production will increase more than 50 percent next year, to 3.5 million yards of fabric a month, mainly because of exports to other Central American countries and to the United States.

“We are going to have a better year just because of the trade talks,” said Cohen, whose modest office overlooks a courtyard where guards tote machine guns and the gray cinderblock walls are nearly 10 feet tall.

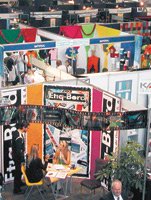

Texzibe was just one of the nearly 200 companies that participated at the 12th annual CBI Apparel Sourcing Show, held May 7–9 in Guatemala. Attendance at CBI increased slightly this year, with more than 4,200 present at the show.

Talks of CAFTA

The three-day event is an opportunity for U.S. and Central American businesses to take advantage of the Caribbean Basin Initiative, which allows Central American goods using U.S. fabrics and yarns to enter the United States free of duties and quotas.

A proposed Central American Free Trade Agreement (CAFTA) would enhance the current initiative by allowing all apparel made in Central American countries to come into the United States duty and quota free. It would be similar to the North American Free Trade Agreement (NAFTA) implemented in 1994 by Mexico, the United States and Canada. CAFTA talks began between U.S. and Central American representatives last January in Costa Rica. Negotiators hope to have an agreement in hand by December.

Several people attending the conference emphasized the importance of a free-trade agreement.

“If you don’t get something in writing at least six months before the presidential elections next November, you can kiss goodbye any significant growth in the region,” said Mary O’Rourke, managing director at the Jassin- O’Rourke Group, a New York strategic consulting company for the apparel and textile industries.

“Discussions on CAFTA have probably opened many new windows for us,” said Marcio Cuevas, president of Guatemala’s Association of Exporters of Non-Traditional Products. “If CAFTA is passed, there will be more investment in Guatemala.”

Many said CAFTA needs to be implemented before 2005, when all import quotas on apparel goods manufactured in China are scheduled to be eliminated.

By lessening paperwork and quota monitoring, a regional freetrade agreement could help Central American manufacturers reduce the cost of each garment made in the region by $1.25. Central American manufacturers are banking on their proximity to the United States to help fill quick-turn orders.

U.S. draw

The prospect of a free-trade agreement, as well as the current Caribbean Basin Initiative, drew several U.S. retailers, manufacturers and textile companies to this year’s apparel-sourcing show. Most came from the Southern and Eastern United States. Only a handful of California companies attended.

David Loo, quality inspection adminstrator for Saks Inc., the Birmingham, Ala.–based parent company of Saks Fifth Avenue, used the show to inquire about producing such things as childrenswear and polo shirts in Guatemala. So did representatives from Wal-Mart Stores Inc., Target Corp. and Carter’s.

Michael Overton, director of purchasing for Rampage Clothing Co., a retail chain based in the City of Commerce, Calif., was there, too.

Executives from Forever 21 Inc., a Los Angeles chain of juniors stores, had planned to attend the event but canceled at the last minute, said German Cerezo, the trade commissioner for the Guatemala Trade & Investment Office in Los Angeles.

This was the first year that Tag-It Pacific Inc., the Woodland Hills, Calif.–based company that bought Talon zippers a few years ago, attended the sourcing show. Tag-It is opening a distribution center in Guatemala City in the next few months and has a joint-venture arrangement to assemble zippers in Guatemala, said Jonathan Markiles, executive vice president of global marketing for Talon International Inc. He noted that Talon’s objective is to capture 10 percent of the Central American zipper market in the next few years.

Twin Dragon Marketing Inc., based in Gardena, Calif., has been attending the show for years. The company manufactures denims, twills, corduroys and woven stretch fabrics in Hong Kong, China, Mexico and the United States. The company is launching a production operation in Nicaragua that will focus on stretch fabrics, primarily for pants.

“We’re here to introduce our CBI-friendly fabrics,” said Bo Dean, the company’s senior vice president of sales and marketing, who added he is marketing the company’s ability to be a fast-turn provider.

Expansion in Nicaragua

E & J Textile Group, a $25 million knitting, dyeing and sewing company based in Hawthorne, Calif., has been coming to the show for the last four years, but executives have never set up a booth. Instead, company Chairman and Chief Executive James Y. Kim spends most of his time matchmaking with various apparel manufacturers and retailers.

“We’ve had four appointments today, and, so far, we have done business with three of them,” he said, noting that Kohl’s was one of the retailers he met with.

E & J Textile has embraced Central America with open arms. In 2001, the company opened a 100,000- square-foot cutting-and-sewing facility in Nicaragua. Recently, the company expanded that facility to 200,000 square feet. Approximately 1,000 employees work in the space.

“I opened in Nicaragua mainly for the low labor costs,” Kim said. “In Los Angeles, a person who sews will cost $1,300 a month. In Nicaragua, the cost is $100 a month.”

Nicaragua is becoming the darling of the Central American apparel industry. There has been an influx of investment in apparel factories, primarily by Taiwanese investors, because of tax incentives and the country’s low labor costs.

Average pay for Nicaraguan workers is less than $100 a month, compared with an average monthly salary in Guatemala of $233. In El Salvador it is $144, according to Guatemala’s Association of Exporters of Non-Traditional Products.