Retailers Sweat Out Tough December '02

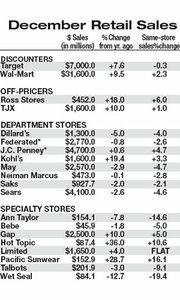

It was a blue, blue Christmas holiday sales season for a number of retailers, with some pockets of strength for teen specialty retailers who benefited from gift card programs. The Bank of Tokyo-Mitsubishi’s chainstore index registered an anemic 1 percent gain in December sales over last year’s results, coming in at half of what was expected. In a reversal of past trends, both discounters and department stores struggled to appeal to consumers. Wal-Mart Stores. Inc. reported samestore sales grew 2.3 percent, below Wall Street’s already reduced estimate of a 2.6 percent gain. Target Corp. said samestore sales were down 0.3 percent, in line with reduced Wall Street expectations, but the results were well below Target’s original projection of a 3 to 5 percent gain. Even Kohl’s Corp. reported a modest 3.3 percent same-store sales increase, far below the 6 percent gain Wall Street anticipated. The sales outcome, however, wasn’t totally bleak as some retailers eked out better-than-expected results. Sears Roebuck & Co. saw same-store sales fall 4.6 percent, a drop smaller than Wall Street expected. Along with solid performances in footwear, sporting goods and fine jewelry, the retailer said it had a strong showing from its sales at its Web site and its Lands’ End business, which it acquired in June. Bebe Stores Inc. reported a 5 percent sales decline, beating Wall Street’s consensus estimate of a 12.8 percent decline. Gap Inc., parent of Old Navy and Banana Republic, produced a 5 percent same-store sales gain for its three concepts, besting Wall Street forecasts of a 3.6 percent increase. And teen retailers Hot Topic and Pacific Sunwear of California had the best gifts of all: samestore sales increases of 10.6 percent and 16 percent respectively. Pacific Sunwear said gift cards for the holiday period surged 40 percent compared to last year. —Nola Sarkisian-Miller