Consumers Leave Department Stores Out in the Cold

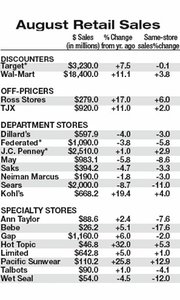

Even retail stalwarts Wal-Mart Stores Inc. and Target Corp. failed to muster impressive sales figures in August as most consumers kept a firm grip on their wallets. Low interest rates and special deals kept shoppers occupied with automobiles and homes, leaving malls in the dust.

In August, Wal-Mart said same-store sales rose 3.8 percent—below its expectation of 4 percent to 6 percent growth—due to soft apparel sales. Target’s same-store sales were down 0.1 percent, below its plan, but the retailer said its third-quarter outlook hasn’t changed.

Most department stores also continued to struggle. Sears, Roebuck & Co. posted a same-store sales drop of 11.1 percent, worse than analyst expectations. Federated Department Stores Inc., parent to Macy’s and Bloomingdale’s, said same-store sales decreased 5.8 percent.

Specialty chains reported mixed results. Ann Taylor Stores Corp. said same-store sales fell 7.6 percent, and Gap Inc., benefiting from an improved assortment of merchandise, posted a betterthan- expected 2.0 percent decline. While some youth retailers posted disappointing results, such as Wet Seal, there were others that made the grade in August. Hot Topic Inc. reported a 5.3 percent increase in sales—well above the company’s earlier forecast of a decline—and Pacific Sunwear said same-store sales increased 12.9 percent, with strength in shoes and juniors apparel. —Nola Sarkisian-Miller