Retail Sales: Department Stores and Discounters

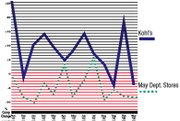

The story of the year continues to be Kohl’s Corp., especially in California where the Menomonee Falls, Wisc.–based retailer won’t operate until April 2003 when it opens 28 units. As department stores and mid-tier merchants duke it out for customer loyalty, Kohl’s strategy has kept it above the retail fray. Retail experts say the company has succeeded in part by steering clear of high-rent malls with multilevel layouts that frustrate timestarved customers. Instead, Kohl’s keeps it simple, with one racetrack-shaped floor of clothes and housewares. And customers appreciate the discount prices on clothes, including Nike, Dockers and OshKosh. Still, analysts question whether Kohl’s can keep up with its torrid pace of growth. The company has expanded from 76 stores a decade ago to 457 today, with sales jumping more than sevenfold to about $8 billion a year over the same time frame. One retailer that has begun to emulate Kohl’s moves is the May Department Stores Company, parent to Robinsons-May. The new, smaller Robinsons-May department store at the Irvine Spectrum Center is more in line with a Kohl’s, with its smaller format, racetrack pattern and shopping carts. It’s one move May has implemented to restructure its challenged business. Earlier in the year, the company streamlined into six divisions, down from eight, combining its Kaufmann’s and Filene’s divisions in the Northeast as well as its Robinsons-May and Meier & Frank units in the West. In June, it announced a push for younger, more forward-inspired clothing with the launch of its private-label brands “Be” and “i.e.” However, in a surprise decision, Bebe Stores Inc. on Oct. 21 won a preliminary injunction in a trademark infringement lawsuit it filed against May. The federal judge barred the St. Louis–based department store chain from selling its “Be” private label brand of clothing, saying the trademark is “confusingly similar” to Bebe. The suit is currently in dispute. —Nola Sarkisian-Miller