Discounters on Hot Streak in November

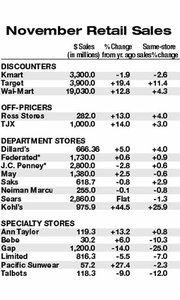

The beating continued for retail sales in November, as discounters continued to steal market share from department stores and specialty retailers.

Analysts hoped for stronger numbers as an indicator of holiday sales. Michael Niemira, vice president of Bank of Tokyo-Mitsubishi, cut his 4 percent holiday forecast down to 2 percent after seeing the retailers’ results.

Those merchants who did post increases benefited from a quirk in the calendar that allowed for one more shopping day after Thanksgiving than there was last year, providing extra post–Thanksgiving Day sales.

Shoppers did their splurging at such discount chains as Wal-Mart Stores Inc., which posted a 4.3 percent sales increase, and Target Corp., which saw sales rise 11.4 percent. However, theirs wasn’t all good news. Target’s gain was slightly below plan, and much of Wal-Mart’s revenue boost came from food sales, which carry lower profit margins.

Value-priced department store chain Kohl’s Corp. saw same-store sales surge 25.9 percent, and TJX Co. posted a 3.0 percent increase in same-store sales, beating Wall Street expectations.

Even deep discounting didn’t help most department stores. Sears, Roebuck & Co., the No. 4 U.S. retailer, said same-store sales fell 1.3 percent, citing weakness in apparel and seasonal merchandise. Federated Department Stores Inc., parent of Macy’s and Bloomingdale’s, saw same-store sales rise 0.9 percent. The company is forecasting an 11 percent to 13 percent drop in December same-store sales.

Specialty apparel retailers had little to celebrate. The most notable drop was the 25 percent plunge in Gap Inc.’s same-store sales. The No. 1 apparel chain warned that fourth-quarter earnings would be “considerably worse” than the 6 cent per share loss reported in the third quarter, excluding the tax-related charge.

Same-store sales at Ann Taylor Stores Corp., impacted by shopper drop-offs at downtown and tourist locations, inched up 0.8 percent. Youth retailer Pacific Sunwear said same-store sales fell 2.3 percent, mostly attributable to the double-digit declines in the Florida market and the weakness in men’s sales. Juniors fleece, pants and sweaters were top sellers for the retailer. —Nola Sarkisian-Miller